The 6-Minute Rule for Pacific Prime

Table of ContentsSome Of Pacific PrimeSome Known Questions About Pacific Prime.The Ultimate Guide To Pacific PrimeThe Definitive Guide for Pacific PrimePacific Prime for Dummies

Your agent is an insurance policy specialist with the expertise to lead you through the insurance coverage procedure and aid you find the very best insurance policy defense for you and the individuals and things you care about the majority of. This post is for informative and pointer purposes just. If the plan coverage summaries in this post problem with the language in the policy, the language in the plan uses.

Policyholder's fatalities can additionally be backups, especially when they are considered to be a wrongful death, as well as residential or commercial property damages and/or devastation. Due to the unpredictability of claimed losses, they are identified as backups. The guaranteed person or life pays a premium in order to receive the advantages assured by the insurance firm.

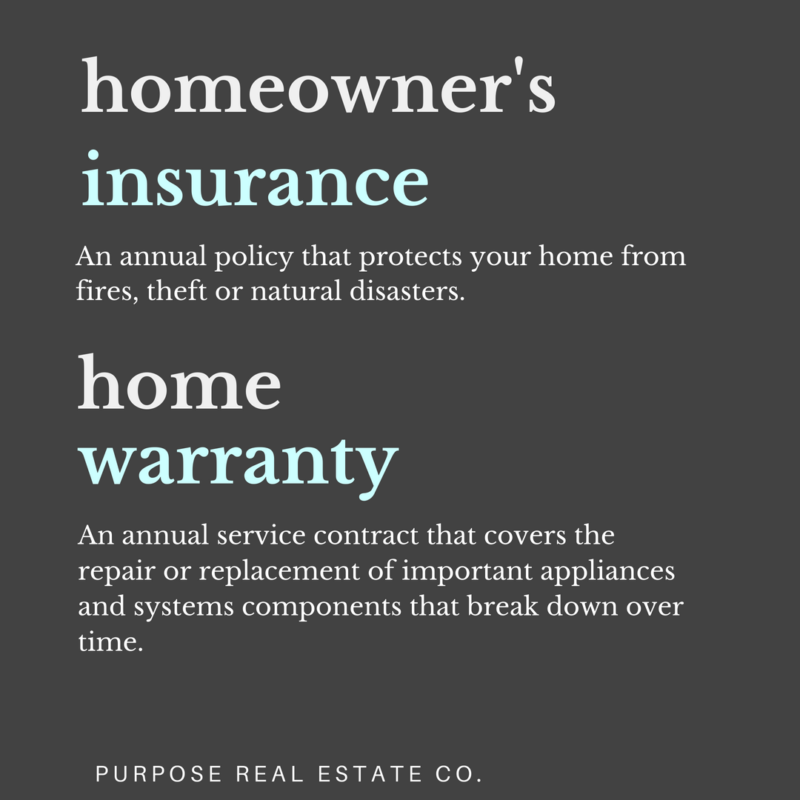

Your home insurance can aid you cover the problems to your home and afford the expense of rebuilding or repairs. Sometimes, you can additionally have protection for things or valuables in your residence, which you can then acquire substitutes for with the cash the insurer provides you. In case of a regrettable or wrongful fatality of a sole earner, a household's financial loss can possibly be covered by specific insurance policy strategies.

The Greatest Guide To Pacific Prime

There are various insurance plans that consist of savings and/or investment schemes along with routine coverage. These can assist with structure cost savings and wide range for future generations through normal or persisting investments. Insurance can assist your family maintain their requirement of living in case you are not there in the future.

The most fundamental kind for this sort of insurance, life insurance policy, is term insurance. Life insurance coverage as a whole aids your household end up being safe monetarily with a payout amount that is given up the occasion of your, or the plan owner's, fatality throughout a particular policy duration. Child Plans This type of insurance policy is basically a financial savings tool that assists with producing funds when children get to specific ages for going after college.

Home Insurance coverage This kind of insurance covers home problems in the events of mishaps, natural calamities, and accidents, along with other similar occasions. group insurance plans. If you are seeking to look for compensation for crashes that have actually happened and you are having a hard time to identify the appropriate course for you, reach out to us at Duffy & Duffy Regulation Company

How Pacific Prime can Save You Time, Stress, and Money.

At our law office, we recognize that you are going with a lot, and we understand that if you are coming to us that you have been through a whole lot. https://on.soundcloud.com/Boznd6XKBGjyrspT8. Due to that, we provide you a free examination to review your problems and see just how we can best aid you

Since of the COVID pandemic, court systems have been shut, which negatively impacts auto mishap instances in a significant means. We have a great deal of seasoned Long Island automobile mishap attorneys that are enthusiastic regarding combating for you! Please call us if you have any kind of inquiries or concerns. expat insurance. Once again, we are below to assist you! If you have an injury case, we intend to see to it that you get the payment you deserve! That is what we are here for! We proudly offer the individuals of Suffolk Area and Nassau Area.

An insurance coverage is a lawful agreement between the insurer (the insurance company) and the person(s), company, or entity being insured (the insured). Reading your policy aids you validate that the policy satisfies your demands which you understand your and the insurance policy firm's responsibilities if a loss happens. Several insureds acquire a plan without recognizing what is covered, the exclusions that eliminate insurance coverage, and the conditions that should be met in order for coverage to apply when a loss happens.

It identifies who Home Page is the insured, what dangers or building are covered, the plan limits, and the policy period (i.e. time the policy is in pressure). The Declarations Page of a vehicle policy will certainly include the description of the lorry covered (e.g. make/model, VIN number), the name of the person covered, the premium amount, and the insurance deductible (the quantity you will have to pay for an insurance claim prior to an insurer pays its section of a covered insurance claim). The Statements Page of a life insurance coverage plan will include the name of the person guaranteed and the face amount of the life insurance coverage plan (e.g.

This is a recap of the significant promises of the insurer and specifies what is covered. In the Insuring Agreement, the insurance company concurs to do particular points such as paying losses for protected hazards, offering particular services, or agreeing to safeguard the guaranteed in a responsibility lawsuit. There are 2 fundamental types of an insuring contract: Namedperils insurance coverage, under which only those perils especially noted in the plan are covered.

Everything about Pacific Prime

Life insurance coverage plans are commonly all-risk plans. https://www.openstreetmap.org/user/pacificpr1me. The 3 major kinds of Exclusions are: Omitted risks or causes of lossExcluded lossesExcluded propertyTypical instances of omitted dangers under a house owners policy are.